There are a lot of ultimate comparisons in the annals of human history. It behooves each of us to familiarize ourselves with these on our path to total enlightenment:

- Dumbledore vs Gandalf

- Superman vs Batman

- Red Sox vs Yankees

- Mac vs PC

- Interstellar vs Gravity–I’ll save you some time right now it’s Gravity

- Darcy vs Rochester

- Washington vs Lincoln–sorry for the US-centrism here

- DC vs Marvel

- Pepsi vs Coke

Now it’s time to put another equally important epic debate to rest. Who should run sales commissions at your company: Finance vs Sales Ops?

Here’s what we’ll cover:

- Evolution of Commissions as Your Company Grows

- Who Should Run Commissions at Your Company

- Case for Finance

- Case for Sales Ops

- Decision Framework

Evolution of Commissions as Your Company Grows

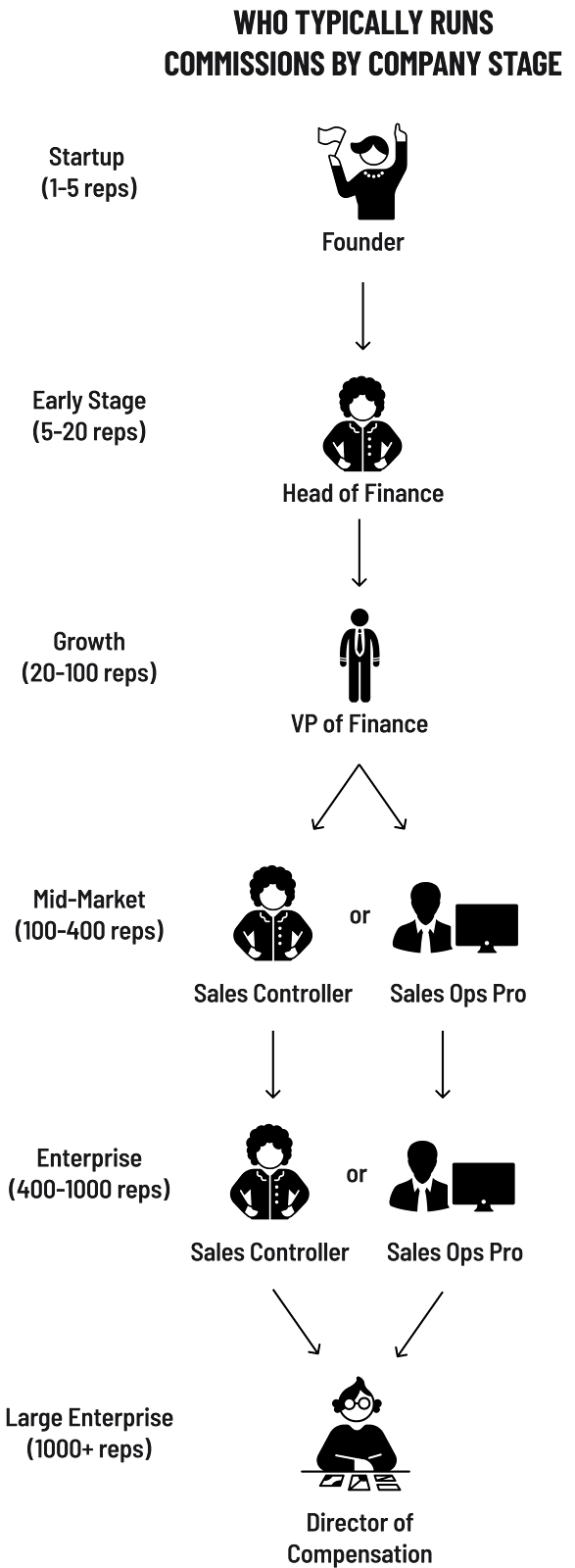

Here at Spiff we’ve looked a commission data from hundreds of companies like Brex, Lattice and Riskalyze. Here’s the evolution of who runs commissions in a graph:

In brand new companies, one of the founders typically runs commissions. For example, at my last startup Capshare, Matt Stapleton ran commissions for us in the early days.

Once a company has somewhere around 5-20 reps, it typically has enough resources to bring in a finance person. This person typically keeps the books, produces some high level financials, and runs payroll. They also handle commissions.

When a company has somewhere between 20-100 reps, they typically have one or more people under a Head of Finance or CFO. We call this person a “VP of Finance” in the graph above but the title can vary. This person reports to whoever runs finance–often a CFO. At this stage this “VP of Finance” typically runs commissions.

An interesting thing happens in the mid-market when companies have approximately 100-400 commissioned employees. Companies like this are large enough that they can create an organization that is completely dedicated to “sales enablement” or “sales ops.” Some do and some don’t. If they do, some of the companies assign someone in the sales ops department to run commissions. Some still leave commissions calculations with the finance team. This same split persists even at the small end of Enterprise companies–companies with 400 to 1000 reps.

At the larger end of enterprise, you’ll find companies who give commissions to thousands of people. These are often big insurance companies, pharmaceutical companies, or medical device companies. At this size, it’s common to create an entire small business unit dedicated to compensation for all those reps.

This is great but how do you know who should run commissions at your company?

Who Should Run Commissions at Your Company?

Well a partial answer to this question is in the graph above. If you are so small that you don’t have a finance person, you should just pick one of the founders that is the most qualified to handle commissions. Founders typically where multiple hats. So this could be the same founder running sales or it could be the more financially oriented founder. You just pick the person who seems most qualified.

If you have the resources to hire a dedicated finance person but you don’t yet have a sales ops team, we recommend putting commissions under the finance org. This is standard practice and at this stage most companies don’t have any other group qualified to do it. You could argue that your Head of Sales could manage it. The problem with this is most sales folks don’t have experience or training running the complex calculations required for commissions. So we’d recommend against this approach.

If you are a large enterprise with thousands of reps, we’d recommend creating a specific (albeit small) department to manage commission calculations.

So what do you do if you have 100-1000 reps? This is where it gets interesting. Many companies make a difficult choice between Finance and Sales Ops.

The Case for Finance

In our experience at Spiff, we see a slightly higher percentage of companies at this stage use Finance to manage commissions vs Sales Ops. We suspect one of the reasons why is because most companies develop a finance organization well before they develop a sales ops organization. So they have already had someone in Finance running commissions.

But there are many reasons why Finance could be a good choice:

- Previous experience running commissions

- Experience with the spreadsheet that powers commissions

- Payroll typically reports up through Finance and the commissions workflow needs to dovetail with payroll

- Finance is in charge of accounting and companies at this stage need to handle accruals on commissions (ASC 606)

So why wouldn’t you always have finance run commissions?

The Case for Sales Ops

Sales Ops focuses on making sales reps successful. While not directly selling, the sales ops team does everything possible to improve the performance of the sales team. Since the whole point of commissions is to drive rep performance, Sales Ops would seem to be a perfect fit for running commissions.

Sales Ops is an organization focused on making the sales machine run smoothly. They typically do this by automating. Since spreadsheets don’t scale, companies that are ready to trash their commission spreadsheets often ask the Sales Ops team for help to manage commissions. Sales Ops teams often have CRM experts on staff. If the company is using Salesforce, they will have a Salesforce admin on staff.

So there are several reasons why you might want your sales operations team to run commissions:

- They will focus on scalable automation technologies

- They think all day long about incentive design and how to optimize sales team results

- They typically have deep CRM technology expertise

Decision Framework

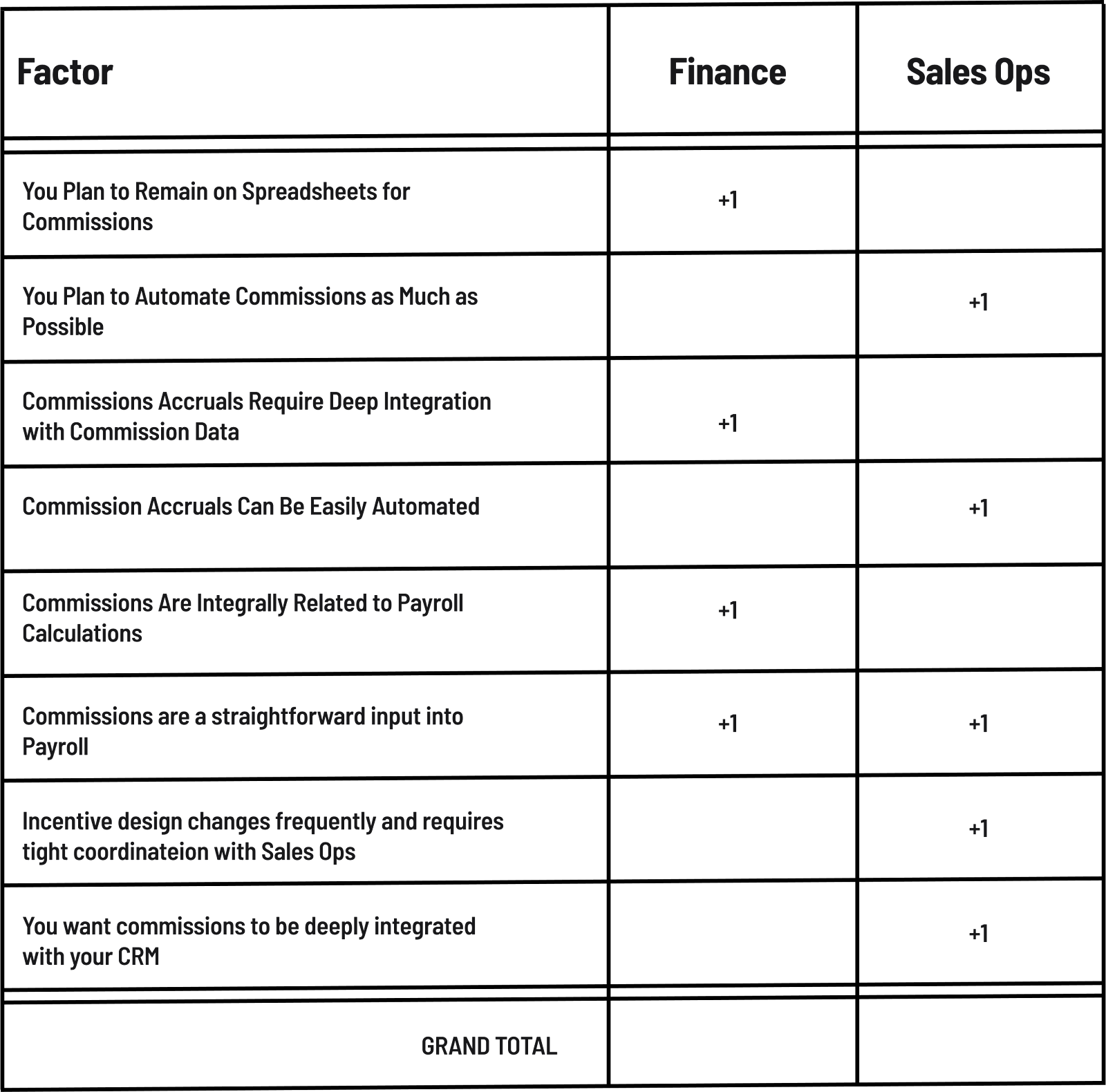

So how should actually decide whether you want to use Finance or Sales Ops to run commissions? The answer should vary for every company but we’ve pulled together a handy decision framework for you.

Look at the factors below and add up points in the Finance and Sales Ops columns. It’s certainly not a perfect science but it can give you a sense of which organization would be best suited to run commissions at your company.

You might want to weight the points by the importance of the factor to come up with a more accurate score.

We hope this helps you figure out who should run commissions at your company. Feel free to reach out to us if you have any questions or comments.

Interested in Spiff? Schedule a demo with a commission specialist today.